Blogs

The brand new certification several months are ninety days from membership beginning. Costs might possibly be acquired within this 30 days after the certification months is over. The lending company is offering probably one of the most competitive product sales in the business, but day try ticking. Should your purpose try becoming towards the top of the spending designs, Pursue membership notice and announcements may help.

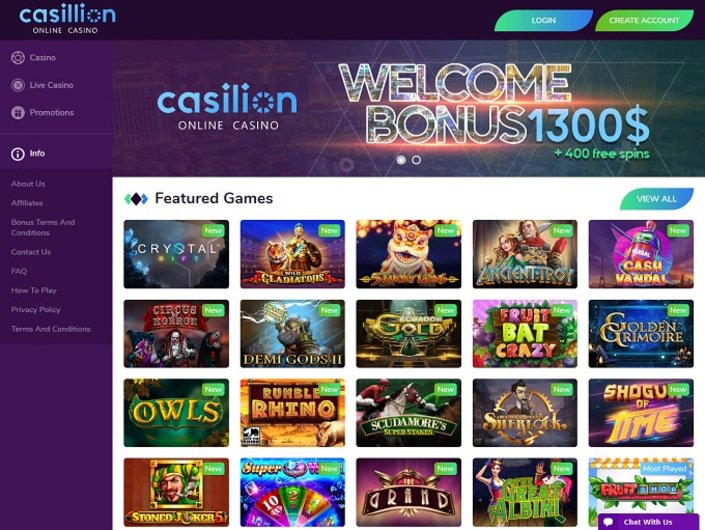

Get A good Once a day Age-send With all The Postings: 138 casino

Which have a great cuatro% APY, a savings equilibrium of $ten,000 create secure more than simply $eight hundred just after a-year. It might not make you steeped, however the earnings are a lot much better than a merchant account having an excellent 0.40% APY, which will earn regarding the $40 cash. To your October. step 3, 2025, the school on the the better high-yield bank account list for the high APY is actually Axos Financial.

Banking institutions Which have Immediate Sign-Up Incentives with no Direct Put Demands

All the details is precise at the time of the newest publish go out, however, check always the newest seller’s website for the most newest advice. The newest Send a friend added bonus can be reportable for you and you may the fresh Irs on the Function 1099-MISC (otherwise Form 1042-S, if appropriate). Pursue provides earned a good reputation certainly one of their consumers. Federal Financial Satisfaction Investigation, Chase Bank gained another-large score out of 678 — right less than Financing You to, and that obtained 694. We determine exposure limitations whenever deposit totals go beyond $250,000 because that aligns having basic federal insurance policies thresholds.

Pursue College or university Examining has no fee every month until you graduate. After ward, a good $6 commission applies if you don’t has one month-to-month digital put or carry the average $5,100000 everyday harmony. New Chase Individual Client Examining℠ customers are able to secure around $step 3,000 inside incentive cash whenever beginning an account with being qualified things. An excellent $step 1,100000 bonus and a good $2,one hundred thousand bonus are also available having shorter qualifying deposit amounts.

Chase offers an excellent $five hundred bonus to own opening up a monitoring and you may family savings. As the 138 casino deposits are so imperative to creditors, they offer a trade. So you can incentivize customers to stash their cash inside offers account and you can almost every other put accounts, banking companies give desire for the deposited finance.

When you’re a bonus give should never be the key reason you sign up for an account, it doesn’t hurt to take advantageous asset of one of them if the financial fits their other conditions. Offers last any where from weeks so you can years, but they are always stored in order to a particular schedule. The brand new Precious metal Credit out of American Display ‘s the brand-new deluxe credit. When you are their yearly percentage is actually highest at the $695, so can be their luxurious perks, along with Amex Membership Benefits, thorough travelling things, and you may annual report credits.

After that you can make the emailed coupon into your local branch to open your account. To get another account extra, you’ll must have a promotional code placed on the application. Whether your’re also a business simply getting started or a professional team with ample cashflow, an advantages-generating Pursue business mastercard can help you take control of your expenses more effectively. Will it really matter and therefore financial you picked to have opening an excellent checking account?

Chase Total Checking and Safer Banking both provides monthly solution charge. Overall Checking features a fee every month from $a dozen, nonetheless it will likely be waived that have lead dumps otherwise keeping a particular equilibrium. A few of the better savings account bonuses and you will bank advertisements to have new clients want direct dumps to qualify, and these tend to be bigger than incentives that do not. So if you is also qualify for such, I recommend seeking to in their mind. Really lender campaigns are available for checking membership, however some banking companies, such TD Bank, give them on the savings accounts, also. In fact, TD has bonuses for two of its savings membership.

You’ll gain access to 15,000+ fee-free ATMs inside the country and you can a wide range of banking, borrowing and paying services. Once you go after the standards, you’ll found the added bonus within 40 days. If you want the thought of earning cash back in your requests and would like to score an easy $five-hundred, this could be a great checking choice for you. These types of banking companies otherwise borrowing unions could have been subject to the fresh the brand new code until they could validate a top percentage otherwise treat it since the a cards equipment beneath the Information within the Financing Act. The cash will be placed on your account 15 days after you’ve got came across all the conditions.

- What’s great about it’s you could merely make an application for Bank account to own $3 hundred bonus that’s better than usually the one he could be giving independently ($200).

- The other eligibility requirements is the examining render isn’t offered in order to established Chase examining consumers and also the savings provide is not open to current Chase discounts users.

- GOBankingRates’ editorial people is actually purchased providing you with unbiased reviews and you can suggestions.

- See U.S. Bank’s webpages on the latest advice, since these campaigns will likely be current otherwise taken at any time.

- Here are the greatest on the web banking companies that have instantaneous sign-upwards incentives without direct put conditions.

Such, which have a good Pursue Bank account, which have simply a great $three hundred equilibrium on your own account at the beginning of everyday inside the statement months usually waive the newest month-to-month $5 provider payment. Rates for the deals accounts along with vary depending on the equilibrium on your membership. Typically, you ought to put a lot of currency whenever opening an excellent family savings and maintain you to balance to own a 90-date period. Pursue has introduced the newest Ink Company Largest® Charge card to their organization bank card lineup.

Pursue Full Examining® Membership charges $twelve month-to-month service charge. You can get you to extra the a couple of years to the a business bank account. Truth be told, using a business savings account has no results at all on your own income tax liability otherwise filing conditions.

Discuss exactly how Axos One to’s included deals and checking membership clear up banking, giving large APYs with no problems from hidden fees! Yet not, very Pursue examining profile do not secure desire, as well as the greatest incentives try set aside for individuals who can meet a $five hundred,100 minimum deposit. It’ll make you a feeling of all you have to create to make sure you get the incentive currency. Both financial institutions can get sly so find out the laws and regulations away from exactly what you ought to be sure they wear’t hose pipe you. The brand new membership has a great $50 minimal beginning deposit however the high give checking account has no minimum equilibrium criteria, pays desire, so there are zero month-to-month maintenance costs.

Continue reading inside MarketWatch Instructions group opinion to understand just how so you can qualify and discover in the event the Chase’s financial incentives can be worth they for you. Because they you may shell out members a high produce, for some banking institutions, providing an advantage is preferable. Other benefits associated with it account are use of Pursue Overdraft Help℠ and you can con defense, in addition to No Accountability Security, con monitoring, and the capacity to secure their cards. The fresh Chase Cellular banking app and you will access to of a lot banks and ATMs is actually smoother benefits. To own $250, discover a simply Family savings and place up a continual lead put totaling $500 or maybe more within 60 days. Following, keep the the fresh currency to possess 90 days away from coupon subscription and you can it could be put in your account within this 40 days.